권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

표제지

목차

Abstract 11

I. 서론 21

1. 문제제기 및 연구목적 21

2. 연구 방법 24

1) 분석적 접근방법 24

2) 연구 분석틀; 연구대상 및 연구범위: 대상지표의 선정, 선정동기 및 내용 24

3) 연구체계 및 구성 30

II. 이론적 논의 33

1. 삶의 질 및 사회의 질에 대한 국제적 논의 33

1) OECD의 논의 33

2) 스티글리츠 위원회의 논의 35

3) Alan Walker and van der Maesen의 ‘사회의 질’에 관한 논의 36

4) Brundtland Report의 ‘지속가능성’에 관한 논의 43

2. OECD 사회지표 44

1) OECD 사회지표의 목적 44

2) OECD 사회지표의 이론적 구조-틀 45

3) OECD 사회지표의 구성 49

3. Esping-Andersen의 복지레짐 유형론 61

III. 사회적 맥락지표의 맥락적 이해 65

1. 합계출산율지표 65

2. 합계출산율지표에 대한 맥락적 이해: 가족정책 비교 66

1) 영국 71

2) 독일 73

3) 스웨덴 76

4) 한국 77

5) 소결 79

3. 노인부양비율지표 82

4. 노양부양비율지표에 대한 맥락적 이해: 노인장기요양보험제도 비교 84

1) 영국 88

2) 독일 90

3) 스웨덴 92

4) 한국 93

5) 소결 94

IV. 자기충족성지표의 분석결과와 논의 97

1. 고용율지표 97

2. 실업률지표 99

3. 고용율·실업율지표에 대한 사회적 대응: 적극적 노동시장정책 비교 102

1) 영국 102

2) 독일 105

3) 스웨덴 109

4) 한국 114

5) 소결 117

4. 연금수급가능기간지표 121

5. 연금수급가능기간지표에 대한 사회적 대응: 연금제도 비교 123

1) 영국 125

2) 독일 135

3) 스웨덴 145

4) 한국 153

5) 소결 159

V. 형평성지표의 분석결과와 논의 164

1. 소득불평등지표 164

2. 공공사회지출지표 175

3. 공공사회지출을 통한 소득불평등을 해소하기 위한 사회적 대응: 공적이전 재분배정책 및 그 프로그램의 재분배효과 비교 180

1) 영국 181

2) 독일 183

3) 스웨덴 184

4) 한국 187

5) 소결 190

4. 저소득탈출에 필요한 소득지표 196

5. 저소득탈출을 위한 사회적 대응: 근로빈곤계층에 대한 사회보험료 감면제도 비교 199

1) 영국 203

2) 독일 204

3) 스웨덴 206

4) 한국 207

5) 소결 208

VI. 요약 및 정책적 제언 212

1) 요약 213

2) 정책적 제언 216

3) 연구의 한계점 222

참고문헌 223

〈그림 1〉 연구체계 및 구성 32

〈그림 2〉 OECD 글로벌 프로젝트 사회진보 분석틀 33

〈그림 3〉 사회의 질을 구성하는 영역 38

〈그림 4〉 욕구, 행위자, 정책과의 관계 42

〈그림 5〉 합계출산율 66

〈그림 6〉 노인인구와 노인부양비 83

〈그림 7〉 노인부양비 추이(1950~2050년) 83

〈그림 8〉 고용율 98

〈그림 9〉 연령대별 임시직 고용인의 비율(2009년) 98

〈그림 10〉 연령대별 고용율의 변화 추이(2007~2009년) 99

〈그림 11〉 실업률 101

〈그림 12〉 교육수준과 청년실업률(2009년) 101

〈그림 13〉 원주민인구와 이주자간의 실업률의 차이(2009년) 101

〈그림 14〉 예상퇴직연령(2010년) 122

〈그림 15〉 퇴직연령 123

〈그림 16〉 영국의 연금체계 127

〈그림 17〉 독일의 다층노후소득보장의 체계 136

〈그림 18〉 개혁이전의 연금체계(기초연금:FP, 부가연금:ATP, 보충연금:TP) 147

〈그림 19〉 개혁이후의 현행 연금체계(보장연금:GP, 소득연금:IP, 프리미엄 연금:PP) 147

〈그림 20〉 소득불평등 165

〈그림 21〉 평균 중위가구소득과 지니계수 165

〈그림 22〉 중위가구소득 변화와 지니계수의 변화 166

〈그림 23〉 소득불평등의 분석틀 167

〈그림 24〉 가구소득분배와 관련된 노동시장 추세와 인구통계학적 변화 172

〈그림 25〉 공공사회지출 176

〈그림 26〉 공공사회지출과 소득불평등의 지니계수 177

〈그림 27〉 공공사회지출 변화와 소득불평등의 지니계수 변화 177

〈그림 28〉 빈곤선(중위소득의 60%)에 도달하기 위한 총임금의 비율(2009년) 198

〈그림 29〉 최종의존급부와 빈곤선에 도달하기 위한 임금(2자녀를 가진 한부모) 198

〈그림 30〉 최종의존급부와 빈곤선에 도달하기 위한 임금(2자녀를 가진 부모) 199

This study aims to provide the political implications to the Korea society for setting on the directions and priorities of future social systems or social programs on the base of social policy comparative analysis focused on the particular OECD social indicators-self-sufficiency, equity indicators- between UK, Germany, Sweden, and Korea which is categorized by Esping-Andersen. In terms of countries analyzed, the UK, Germany, and Sweden represents the liberal, conservative, and social-democratic welfare regime, respectively.

First of all, on the basis of this research's result, summarizing the feature of social policy or social program, by the welfare regime in short, the liberal welfare regime, particularly, the UK shows the feature on the premise of market superiority which takes the principle of less eligibility or the self-help on the dominant labor ethics, therefore, the social risk category is limited to the market failure, and it becomes the dominant means including the social assistance by the property·income test, the low level of universal income transfer or social insurance plan, and etc.(Esping-Andersen, 1990). Consequently, the de-commodification effect through the labor market is minimized, and the sphere of the social rights is effectually limited. In addition, as a result, the dual, that is, hierarchical and political configuration between the normal citizens and the welfare of state dependent is created(Esping-Andersen, 1990).

The conservative welfare regime, particularly, Germany shows the feature concentrating the resources on the social risk by the family failure on the premise of familialism taking the tradition and social solidarity seriously up, inducing the family member, mainly, woman to take charge of the traditional family function continuously like the upbringing or nursing, and intensifying the authority of paterfamilias. That is, inheriting the heritage of corporatism·statism historically and by coupling in the status differentials which maintains and preserves status gap and familialism with premise of principle of subsidiarity dominant, the de-commodification is limited to the householder, particularly, the male breadwinner. Therefore, as the state provides the service not on market failure but on the failure of family, the private insurance and the fringe benefits of company is marginalized mainly(Esping-Andersen, 1990).

The social-democratic welfare regime, particularly, Sweden bases on several peasantries, even though the scale is small but the social risk category is expanded to the side including the human development, the universalism based on the extending coverage of comprehensive social risk, generous benefit level, and equalitarianism, and also the de-commodification principles of social rights is enlarged and applied with the basis till the middle class(Esping-Andersen, 1990). In addition, as the result of influence of the impetus of the powerful central trade union about the social reform, the state tries positively in order to minimize the marketization and implement the welfare with the de-commodification(Esping-Andersen, 1990). Therefore, with premises of the policy object being all peoples, the risk bearing by the market failure being in the state, the state's role for the equality guarantee as the compensation system about the hierarchical society is very big, and also the extent of the de-commodification is the biggest.

In this context, the political implications which this research gives to the Korean society for setting on the directions and priorities of social policy or social program is like the following.

First, The family policy of Korean society for coping with the issue of low childbirth·aging society needs to put the top priority on work-family friendly policy including the work-family reconciliation policy, gender equality policy, daycare and caring's socialization policy, and etc., for enhancing the woman's labour market entrance, at the same time refloating the birthrate. For example, It has the political implications to the Korean society that Sweden's work-family friendly policy lowers the woman's labour market entrance cost and raises the woman's employment rate at the same time and the fertility through the appropriate harmonization which the socialization of the family caring including the public daycare, and familialization of caring including motherhood and paternity leave system are comprised. Therefore, In case of the Korean society, in order to build up the family-friendly working environment including the good quality of infants and children daycare service which is expanded to the flexible form and strengthen support of daycare fee, upward adjustment of the provision means of child allowance for the low-income working family, flexible working time, home office, selective working time and etc. in a mold of the hiring as regular worker on payroll institutionally, the political effort needs to be groped. Particularly, the Korean society in the situation where the woman's education level surpasses the man's one, and moreover the working population reduction is expected, has being maintained and developed this power for growth through the more efficient investment in the human capital in order to escape from the low birthrate durability, decrease of pregnant woman population, reduction of the desirable number of children and etc. so called, 'the trap of low childbirth' of Korean society. Moreover, the penalty including the dismissal according to the prenatal and postnatal leave and childcare leave is downright cracked down, the back-to-work after temporarily leave or the leave legally is intensified, and also it needs to be considered that the employer and males improve the workplace culture so that the more women can work, and the more males can share the housework(Lee? Choi, 2010).

Second, For the Korean society's long-term care insurance system for elderly which corresponds to the socialization of caring cost according to the aging, on the premise of construction of new system that can supervise so that the service user and provider can be effectually supported, the regulation of state needs to be strengthened in order to induce to 'the restricted quasi-market' including the strict operation of provider sorting mechanism, price control through setting on the standardized service price and etc.. More concretely, on the premise of the security of sustainable service finance through the premium taxation system improvement and etc., the competition in the service market through the extending coverage of the service subject is promoted, the improvement of service quality through the actualization of insurance fee is planned, the option of the service user through the improvement of cash benefit system and the expansion of voucher system are increased, the user excess level acted as the barrier of service use is lowered, and the systematic administration and supervision of the service market is needed. Moreover, in the UK's socialization policy of caring, by accommodating the caring role of informal carer as 'the social risk' which has to be solved in the public social security system through the partnership system construction between formal and informal caring which can contribute to strengthen the family relationship, protect the rights and interests of the caring subject and provider, back up the work-family compatible, improve the paid labor productivity, secure the woman?s employment location and establish the right to work, create the effect in the de-gender of providing the caring labor, alleviate the informal carer's burnout and burden, and etc., it has the political implications to korean society that the UK guarantees the right as the equivalent citizen along with the social recognition about the informal carer's caring role in that the informal carer takes on the demand of insufficient formal caring service, and also the informal carer is the service user, service provider and citizen(Kang, 2009).

Third, Agreeing with the globalization and knowledge-based economy era, the active labor market policy of Korean society which overcomes the unemployment and raises the employability, on the base of exact information including the future industrial structure change, the labor demand prediction by industry, and etc., needs to be carried out specialized in the basis so that the flexibility and security at the labor market can be connected, according to the labor market disadvantage group. Particularly, the active labor market policy which raises the young man employment rate through the introduction of characterization education or active internship program connected with employment, as to section of education, in the provider side, as to company section, in the user side, as to government section, in the institutional side, as it is required in the organic collaboration relationship, cannot be made by the effort of one section of Korean society. Therefore, the active labor market policy specialized against the young man, as to the British characterization education policy of the corporate customized by the collaboration between company and college, will be the structure of the good circulation which causes not only economical effect which reduces the private, company, and government's cost for the education expenditure but also the psychological stabilizing effect though the employability improvement. Moreover, in the active labor market policy, as the action or attitude of employers which consider the major reason of program participation in not improving the skill of labor force or implementing the company's social responsibility but in securing of the low wage labor force subsidized by government support, and which regard the long-term unemployed participated in the program as not suitable the potential adoptable person, has an effect on the concrete formation and fulfilment of welfare policy, the employer's role of social responsibility needs to be raised(Kim, 2006). Probably, the employment policy of good circulation will be, the first, by inducing drastic deregulation and active investment in the private section through pro-entrepreneurial policy, creating the decent jobs, and then through these employment, making the income distribution smooth, in the secondary, in the public section, by promoting the employment of working poor classes along with the work incentive system like EITC, enforcing the workfare policy, while the public and private section maintains the close collaboration system. Particularly, the latter on the base of mutual duty rule among the state and nationals, needs to approach the policy in which the employment integration and income guarantee keeps pace. In the mutual duty rule, it means that the state try in order to support the beneficiary, while the people, particularly, the working poor classes do best for seeking a job activity and participating in the productive activity(Kang, 2008). In addition, in the expansion aspect of extension of workfare policy, the activation policy having the concern in the mutual respect of the right and obligation and also the state's duty of labor market program and job creating, through the activation of system, has the political implications to Korean society(Shim, 2011).

Fourth, Positively the pension system of Korean society for the income guarantee of the later years, in order to supplement the income replacement rate for 20% reduction by the pension reform in 2007, needs to consider the introduction of public pension shortage's substitution method by the German type's private pension. Because, the activation plan by the active financial·regulatory measures paying this subsidy, in consideration of the scale of a market of private pension of Korean society, by strengthening increasingly particularly, the retirement income guarantee character of private pension, will be expected to accomplish the real outcome in the institutional activation of private pension. This means that the retirement income guarantee character of private pension, considering that the private pension of the Korean society is used in the means of increasing income through the tax deduction benefits rather than becomes the retirement income guarantee, needs to be strengthened by the German style's active regulation rather than the UK's passive regulation(Kim, 2009). Moreover, as the flexibility plan of UK type's premium payment method can be considered as the method required for the diffusion of private pension, the active introduction needs to be considered, at a same time, considering the realistic situation in which the awareness of the peoples about the retirement income guarantee of Korean society is insufficient, the reliability of the people about the pension system is low, and the social security system is immature, in order to prepare for the retirement provision by oneself, improving the 'My Pension Service of formal NPS' constructed recently of National Pension Management Corporation, by reconstructing the pension portal site which provides the comprehensive information about the substantial retirement life design and the private and public pension, the information service needs to be provided.

Fifth, The public transfer redistribution policy for alleviating the income inequality through the public social expenditure needs to be strongly corresponded to the social instability of poverty by enlarging the state intervention for the most fundamental goods, that is, the cash benefit like the child allowance as the demogrants, and the housing benefits, and benefit in kind like the daycare, education, health care, and etc., so that can enhances the publicness. Because, in spite of the formal aspect of overall social security system was constructed by either before or after in 1987, the democratization, in 1997, the foreign exchange crisis in a certain degree, Korean society, due to recently the social security system for the working poor classes including National Basic Living Security System and EITC is adjusted on the target efficiency, stays still in the very residual social assistance system. Moreover, the wide blind-spot zone of immature national pension and employment insurance can do in being the direct case showing that social safety net of the working poor classes or non-regular worker is insufficient. Therefore, in the Korean society, considering the immature social welfare and the low level of social welfare expenditure, restricted role of the unemployment benefit and social insurance system, role reduction of the family and company welfare, and etc., as the National Basic Living Security System, that is the nearly unique poverty policy, at a same time the final social safety network, reflects the characteristic by family scale only in the estimate of existing minimum cost of living which bases the selection of the beneficiary and benefit level, based on medium and small city, by improving in order to reflect the regional and by family pattern characteristic, reducing the poverty through the substantial extending coverage of the beneficiary, the income inequality between social classes needs to be alleviated(Moon, 2005). This means that as the public benefits influence the maintenance of life of the state member very big, the parliament like the advanced welfare state, particularly, Germany, needs to regulate by oneself the clause related to the social fundamental human rights, that is, the key of social security system including the coverage, benefit level and range, premium, and benefit level condition, etc.(Lee, 2010).

Finally, As the social insurance contribution reduction and exemption scheme for the working poor classes for escaping from the low income raise not only the creation of employment but also the social insurance joining induction as the work incentive compensation policy carrying the character of working conditional benefit, it can contribute to the consolidation of social safety net for the working poor classes. Therefore, Korean society needs to introduce actively institutionally. Because, drawing up the social insurance joining rate and reducing the blind-spot zone of the social insurance drastically in the same time, promoting to convert the existing temporary position to the full time position, will be expected to create the positive effect contributing to the stability of public finance of the social insurance, furthermore, the overall financial stabilization through the stable payment of the earned income tax, and etc. In this reason, in case of the small and medium companies less than the certain scale, as converting the existing temporary position to the full time position by reducing and exempting the social insurance contribution including the employment insurance contribution for specified period or implementing the preferential measure on tax system for the pertinent company, eventually makes a reduction of the hiring cost, it is determined to be the measure about the company for enlarging the employment at the same time, and also to contribute to the method ensures the whole stability of social insurance and public finance. However, in order to implement the superiority of social insurance contribution reduction and exemption method, firstly, according to each enterprise employment condition, by applying the reduction ratio differentially, minimizing the blind-spot zone of social insurance, the optimal wage subsidy achievement needs to be planned.

However, as described in the above, the liberal welfare regime and social-democratic welfare regime on the base of this political implications are very different in the character like the both sides of the penny. The both sides bases on the market economy and democracy, but it is the view in which relatively the former takes the market, efficiency, and competition seriously, relatively the latter takes the democracy, fairness, and solidarity seriously. Even though there will be the extreme left wing denying the market economy itself, however, the positive side of market affirmation which brings the efficiency by the competition from the step historical development of the modern society at least cannot be denied. However, depending on the political, social, cultural origin of each the state, the accessible method for the welfare need is different, as the development of welfare by the market and public section and the boundary of these doesn't exist clearly, by being excessively promoted from the political process where the state readjusts the development of these, there is the possibility to advance on the market suprematism or the welfare suprematism always. Therefore, in this view, the European-style welfare system also causes the problem, that is, the former, the income polarization, and the latter, the financial stability. Therefore, it is considered whether it is the time when the Korean society member, everyone has to call wisdom together in order to increase the percentage of institutional completion of Korean style social welfare system which is politically realizable, economically capable, socially acceptable, and ecologically the sustainable, by analyzing these institutional outcomes carefully so that it can be of help to not only the individual development but also development of the state by minimizing the implementation mistake and negative effect, and maximizing the positive effect.*표시는 필수 입력사항입니다.

| 전화번호 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

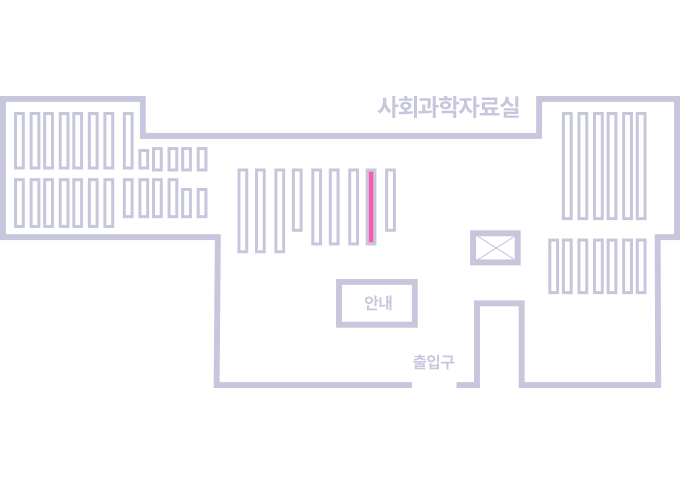

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.