권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

Purpose: This study examines the performance of 35 Indonesian Consumer Non-Cyclical Companies through fixed asset, cost of goods sold, and operating expenses as independent variables and market value as mediating variable to company dynamic performance.

Design/methodology/approach: Dynamic performance describes how much the company's ability to comprehensively processing their business (fixed assets (FA), operational expense (OE) and cost of goods sold(COGS)) to produce value which signalled the market as market value or capitalization. Data envelopment analysis (DEA) used to produce numerical data for FA, OE, and COGS. The data collected through company's annual report for 14 years.

Findings: Our data suggest that all of company inputs such as fixed assets, operational expenses and cost of goods sold have a negative path coefficient to Dynamic Performance. Data suggest that the more productive a company, the smaller its dynamic performance. Moreover, the higher the market value of a company, the smaller the company dynamic performance. Simultaneously, mediating role of more likely it is to has the effect of reducing company dynamic performance.

Research limitations/implications: The mediating variable in this study is market value which is not related to the input variables in this study. For further research, it can use moderating variables related to investment risk, profit projections, economic growth, and public policy because macro things are more visible in the company's operations in the eyes of stakeholders.

Originality/value: This research provides a new understanding related to efficiency, where efficiency is not necessarily generated from a series of production processes, but it needs to be observed that certain values of each input variable can produce a negative relationship to the achievement of dynamic performance.*표시는 필수 입력사항입니다.

| *전화번호 | ※ '-' 없이 휴대폰번호를 입력하세요 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

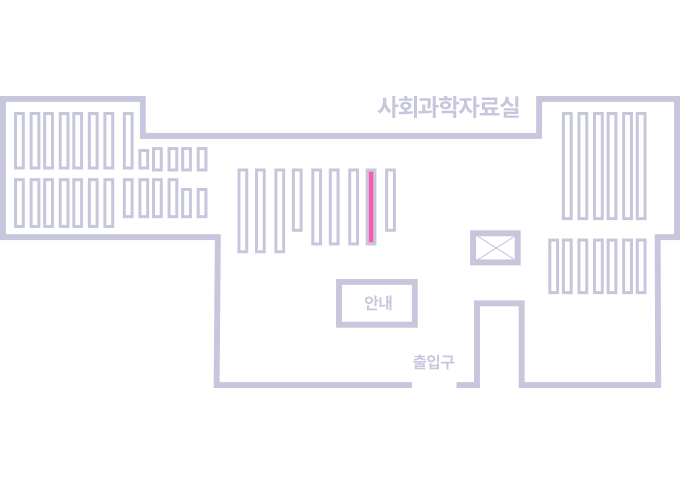

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.