권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

| 등록번호 | 청구기호 | 권별정보 | 자료실 | 이용여부 |

|---|---|---|---|---|

| 0002763013 | LM 343.068 -A21-1 | 서울관 서고(열람신청 후 1층 대출대) | 이용가능 |

The Future of the Profit Split Method

Edited by Robert Danon, Guglielmo Maisto, Vikram Chand & Gabriella Cappelleri

Among the various transfer pricing methods, the profit split method (PSM) is under the spotlight after the OECD's Base Erosion and Profit Shifting (BEPS) project. However, both expert analysis and experience indicate that this method is not straightforward either for taxpayers to apply or for tax administrations to evaluate. In this thorough and detailed commentary - the first book to analyse this increasingly adopted transfer pricing method - notable scholars and practitioners working in the international tax community express their views on the method, answering some unresolved questions and highlighting issues that are still open and pending, especially in light of the digitalization of the economy.

Crucial issues covered by the contributors include the following:

Moreover, relevant experience of applying this method in France, Germany, Italy, Spain, Switzerland, the United Kingdom, and the United States is provided. A concluding chapter also deals with selected industry experiences.

Due to a high level of uncertainty in alignment with international guidance in the application of the PSM - and to the underdeveloped nature of current literature on the subject - there is a need for this book because both tax administrations and taxpayers, going forward, will apply the PSM extensively. The book is highly relevant for policymakers, tax administrations, practitioners and academics engaged in the areas of international taxation, transfer pricing and tax policy.

*표시는 필수 입력사항입니다.

| *전화번호 | ※ '-' 없이 휴대폰번호를 입력하세요 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

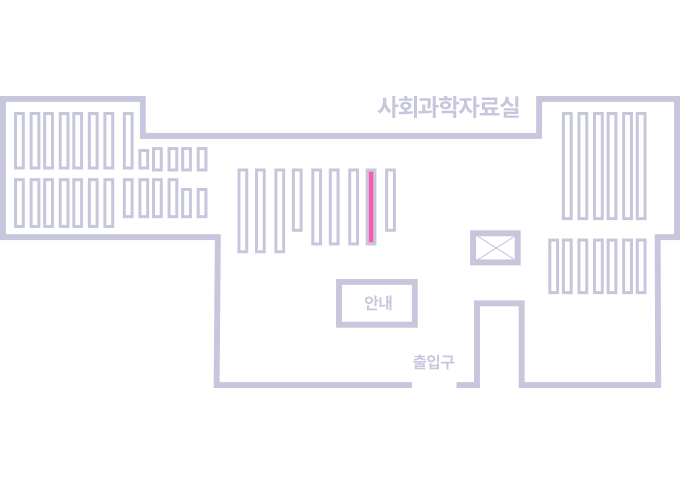

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.