권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

Title page 1

Contents 3

Abstract 1

Basel III and SDG 10: Dealing with the financial inclusion issues of SMEs 5

The problem 5

What to do? 7

Basel III and SDG 8: Supporting infrastructure finance in EMDEs 9

The problem 9

What to do? 11

Adjust the NSFR 12

Concluding remarks 14

References 16

Figures 3

FIGURE 1. Minimum capital requirements adopted in selected countries 6

FIGURE 2. Infrastructure and other project finance debt performance by region, 1983-2018: Ultimate recovery rate 11

Basel III—the international standard for banking regulation—has strengthened global financial stability but has also led to unintended consequences that may hinder progress toward key Sustainable Development Goals (SDGs). This paper examines how Basel III’s regulatory framework may restrict bank lending to SMEs (impacting SDG 10) and constrain infrastructure finance (impacting SDG 8). Addressing these challenges requires refining risk assessment methodologies while preserving Basel III’s core objective: accurate risk evaluation. For SMEs, tailoring risk weights using local credit registry data can better reflect economic conditions in emerging markets. For infrastructure, recognizing it as a distinct asset class and leveraging credit risk mitigation tools could improve financing. Greater engagement from multilateral institutions, particularly the World Bank, is essential to advancing these solutions while maintaining financial stability.

*표시는 필수 입력사항입니다.

| *전화번호 | ※ '-' 없이 휴대폰번호를 입력하세요 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

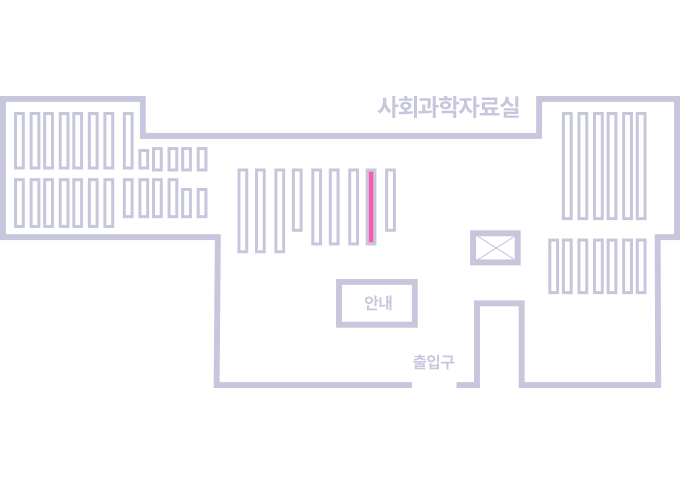

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.