권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

표제지

목차

제1장 서론 9

제1절 연구의 목적 9

제2절 연구의 범위 10

제2장 보험설계사의 의의와 보험업법의 규제 13

제1절 보험설계사의 의의 13

I. 개념 13

II. 보험대리점 및 보험중개사와의 구별 17

1. 보험대리점과의 구별 17

2. 보험중개사와의 구별 19

제2절 보험설계사의 현황 21

I. 수와 분포 21

II. 보험판매조직의 위상 22

III. 향후의 전개 24

제3절 보험업법의 규제체계와 그 내용 26

I. 서언 26

II. 자격의 취득 27

III. 자격의 상실 30

IV. 일사전속과 교차모집 32

V. 모집관련 준수사항 35

1. 보험안내자료 35

2. 통신수단을 이용한 모집관련 준수사항 36

3. 모집에 관한 금지행위 37

4. 특별이익의 제공금지 39

5. 수수료 지급 등의 금지 40

제3장 보험설계사 위촉계약과 보험설계사의 지위 41

제1절 위촉계약 41

I. 의의 41

II. 법적 성질 42

1. 고용과의 비교 42

2. 도급과의 비교 44

3. 위임과의 비교 45

4. 검토 46

제2절 상법규정의 적용문제 49

I. 상업사용인 여부 50

II. 보상청구권의 문제 51

제3절 보험설계사의 근로자성에 관한 논의 52

I. 근로기준법상의 근로자 여부 52

1. 서 53

2. 학설 54

3. 판례 59

4. 검토 62

II. 노동조합법상의 근로자 여부 63

1. 서 63

2. 학설 65

3. 판례 68

4. 검토 71

제4절 소결 72

제4장 보험설계사의 권한과 보험자의 책임 75

제1절 총설 75

제2절 보험설계사의 권한 76

I. 보험계약체결권 76

1. 학설 77

2. 판례 80

3. 검토 82

II. 고지수령권 85

1. 서 85

2. 학설 87

3. 판례 94

4. 검토 96

III. 보험료수령권 98

1. 서 99

2. 견해의 대립 100

3. 검토 102

IV. 보험약관의 교부·명시권 105

제3절 보험설계사의 위법행위와 보험자의 책임 110

I. 민법상의 책임 110

II. 보험업법상의 책임 113

제4절 소결 116

제5장 결론 118

참고문헌 121

ABSTRACT 125

Since the system of insurance solicitor was introduced to Korea, insurance solicitors have made a great contribution to the growth of all fields of life and liability insurance to this point. To this point, the insurer have been able to expand the insurance market through insurance solicitor and improved the productivity, and saved the business costs by the performance-based wages and realized the high growth of contracts. However, there have also been some problems from incompetence or focusing only on the performance record by some insurance solicitors, causing the incomplete sales activities that have been emerged as problems. In particular, unlike the appearance or recognition of the insured, the insurance solicitors have not possessed various authorities that there are a number of legal problems occurred.

In the middle of the problems arising from the legal status of the insurance solicitors, there is the commission contract of the insurance solicitors. The relationship between the insurers and insurance solicitor can be understood by learning the legal nature of the commission contract, and under the nature and contents of such a commission contract, the decision on possession of various authorities related to the execution of the insurance contact and recognition of status of an insurance solicitor as employee is determined.

As a result of comparison of employment, contract and mandate contract under the Civil Code to find out the legal characteristics of the commission contract, it is not a typical contract applicable to anyone of them, but it may be interpreted as the anonymous contract mixed partially with the characteristics of contract and partially with the characteristics of mandate contract.

The purpose of this thesis is to clarify the legal status of the insurance solicitor and contribute to the reduction of insurance dispute by finding the improvement. And this type of work is a great help in protecting the insured in consequence.

In Chapter Ⅱ, this study takes a look at the implication of insurance solicitor and the regulation on Insurance Business Act comprehensively. First, the concept of the insurance solicitor, and common points and different points with other subscription assistants, such as insurance agent and insurance brokers are learned. Next is the study of present condition for the insurance solicitor with respect to the number, distribution, position as the insurance marketing system and development of future for the insurance solicitor system. Lastly, the Insurance Business Act, only the current law that regulates the insurance solicitor is learned.

In Chapter Ⅲ, the discussion on the status of the insurance solicitor is undertaken based on the commission contract of the insurance solicitor. Formation of internal legal relationship between an insurance company and an insurance solicitor is learned by taking a look at the commission contract of the insurance solicitor. And, this study takes a look at the issue of whether the insurance solicitor is applicable to the trade employee(commercial representative, strictly) under the Commercial Code and the issue of applying the assumptions on the compensation claim of commercial agent, and the study focuses on the recent theories and case studies on the recently emerged as social issue on 'applicability of insurance solicitor for employee or employer'.

In Chapter Ⅳ, this study looks at the authority of the insurance solicitor and the responsibility of the insurers on the delict of the insurance solicitor. First, the discussion is on whether the insurance solicitor who undertakes the insurance subscription in the front line of subscription activities enjoys the authority to enter into the insurance contract, authority to receive notices(relating to disclosure and representation), authority to receive the insurance premium as in the existing discussions or is there a room to partially recognize it, and whether the insurance solicitor has the authority to distribute and specify the insurance policies. And, the study is on the responsibility of the insurers under the Civil Code and Insurance Business Act in the event that it incurred losses to the insured and others during the course of subscribing for insurance by the insurance solicitors.*표시는 필수 입력사항입니다.

| 전화번호 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

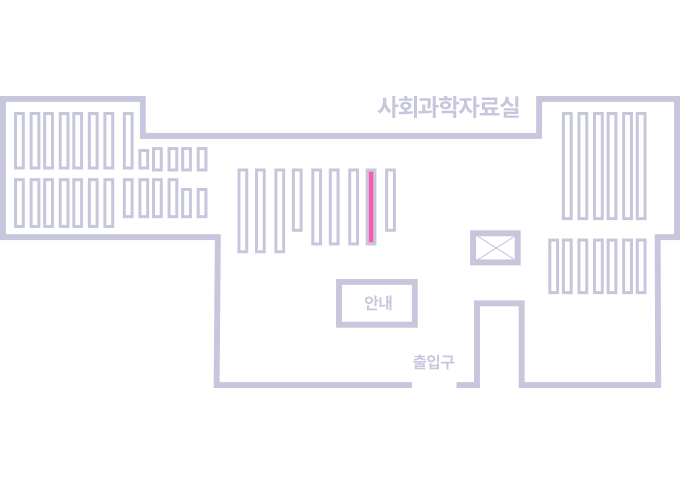

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.