권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

영문목차

Contents

Preface vii

1 Introduction by William G. Gale, Benjamin H. Harris, J. Mark Iwry and David C. John 1

PART I AUTOMATIC SAVING STRUCTURES

2 Retirement Saving for Middle- and Lower-Income Households: The Pension Protection Act of 2006 and the Unfinished Agenda by William G. Gale, J. Mark Iwry and Spencer Walters 11

3 The Automatic 401(k): Revenue and Distributional Estimates by Christopher Geissler and Benjamin H. Harris 28

4 Pursuing Universal Retirement Security through Automatic IRAs by J. Mark Iwry and David C. John 45

5 National Retirement Savings Systems in Australia, Chile, New Zealand, and the United Kingdom: Lessons for the United States by David C. John and Ruth Levine 84

PART II TAKING THE MONEY OUT

6 Increasing Annuitization in 401(k) Plans with Automatic Trial Income by William G. Gale, J. Mark Iwry, David C. John and Lina Walker 123

7 Automatic Annuitization: New Behavioral Strategies for Expanding Lifetime Income in 401(k)s by J. Mark Iwry and John A. Turner 151

PART III RETIREMENT SAVING FOR VULNERABLE GROUPS

8 Retirement Security for Latinos: Bolstering Coverage, Savings, and Adequacy by Peter R. Orszag and Eric Rodriguez 173

9 Retirement Security for Women: Progress to Date and Policies for Tomorrow by Leslie E. Papke, Lina Walker and Michael Dworsky 199

10 Strategies to Increase the Retirement Savings of African American Households by Ngina Chiteji and Lina Walker 231

Contributors 261

Index 263

| 등록번호 | 청구기호 | 권별정보 | 자료실 | 이용여부 |

|---|---|---|---|---|

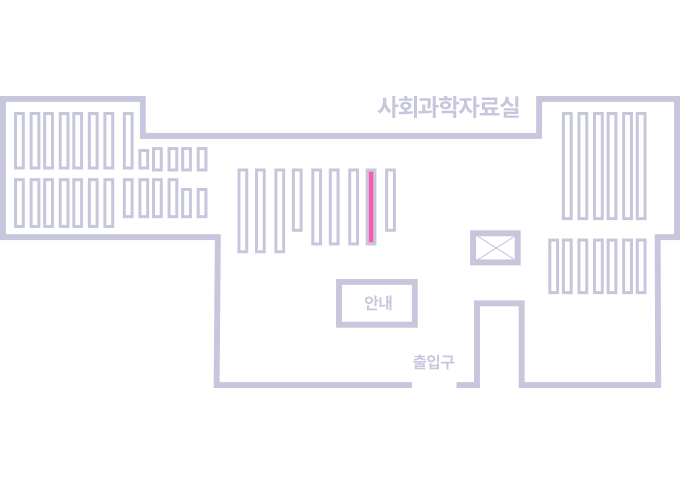

| 0001557188 | 339.430973 -A10-3 | 서울관 서고(열람신청 후 1층 대출대) | 이용가능 |

Automatic offers an innovative new way to think about how Americans can save for retirement.

Over the past quarter century, America's pension system has shifted away from defined benefit plans and toward defined contribution savings programs such as 401(k)s and IRAs. There is much to be done to improve the defined contribution system. Many workers fail to participate and those who do often contribute too little, invest the funds poorly, and are not adequately prepared to manage funds while in retirement.

To resolve these problems, the authors propose that employees should be automatically enrolled into a 401(k) plan when they are hired, with the right to opt out, change the amount that they contribute, or change investment choices if they choose. If the employer does not sponsor a 401(k) or similar retirement plan, they would be enrolled in a payroll deduction Automatic IRA. This vision of a transformed defined contribution system incorporates key positive features of defined benefit plans to improve retirement security. Employess contributions would increase over time, their investments would benefit from professional management and rebalancing, and they would receive lifetime income upon retirement. These automatic features will make the 401(k) and similar plans a more effective tool for retirement saving, and they can be extended to the many workers who do not currently have access to an employer plan.

In Automatic, the authors present proposals to implement automatic features in all phases of the 401(k) and in IRAs for workers with no employer plan. They also draw from the experience of countries that have implemented automatic saving structures.

"*표시는 필수 입력사항입니다.

| *전화번호 | ※ '-' 없이 휴대폰번호를 입력하세요 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.