권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

Title page 1

Contents 1

Abstract 2

1. Introduction 3

2. Anchored Inflation Expectations 5

3. An Illustration of the Benefits of Responding to Long-run Inflation Expectations 9

4. A small model 11

5. Quantitative Evaluation in a Large-Scale Policy Model 21

6. Do the results owe to a focus on inefficient policies? 27

7. Conclusions 30

References 31

Appendix 1: Calibration of Shocks in Small Model and FRB/US Model 35

Appendix 2: Model Codes and Replication Files 36

Appendix 3: Data 37

Tables 8

Table 1. Summary statistics for measures of expected inflation 8

Table 2. Calibrated parameter values for small model 13

Table 3. Simulated Outcomes in Small Model Under Alternative Policy Strategies 20

Table 4. Simulated Outcomes in FRB/US Under Alternative Policy Strategies 26

Table 5. Simulated Outcomes Under Policy Strategies with Rule Coefficients Optimized for the Small Model 29

Figures 6

Figure 1. Measures of inflation expectations from surveys and financial markets 6

Figure 2. Survey measures of 5yr, 5yr forward inflation in selected countries 8

Figure 3. Nominal Interest Rate and Inflation Under Alternative Policy Reaction Functions 10

Figure 4. Impulse responses to monetary, aggregate demand, and aggregate supply shocks in small model 14

Figure 5. Impulse response from shock to the equilibrium real interest rate 15

Figure 6. Impulse response with and without policy response to far-forward inflation expectations 17

Figure 7. Impulse response in presence of ELB with and without policy response to far-forward inflation expectations 18

Appendix Tables 36

Table A. Simulated Outcomes Under Policy Strategies with Rule Coefficients Optimized for the Small Model 36

*표시는 필수 입력사항입니다.

| *전화번호 | ※ '-' 없이 휴대폰번호를 입력하세요 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

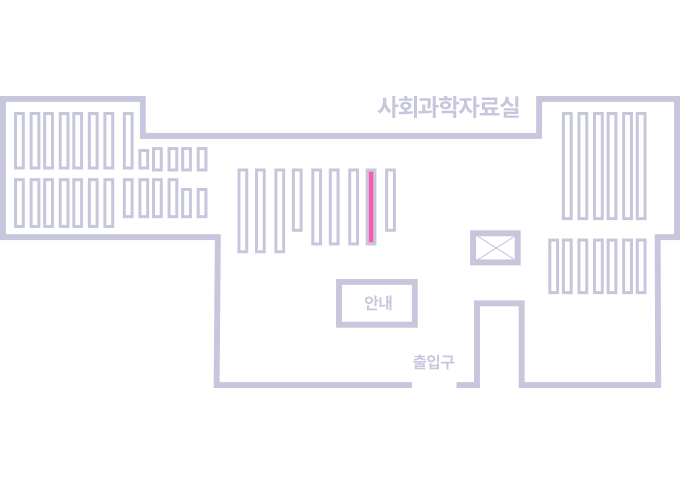

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.